How do you acquire another business on terms that maximize future value?

Buying a business is an exciting proposition, but it is also a complex one. To maximize value you need to look at the acquisition opportunity from various perspectives.

Mergers and acquisitions are a great to leverage the growth of your company, but they're tricky.

Value creation from an acquisition hangs on successful integration. You only get a return when you get that part right.

Growth is about speed and momentum, it involves scaling up your operations, expanding your product range and selling into new markets.

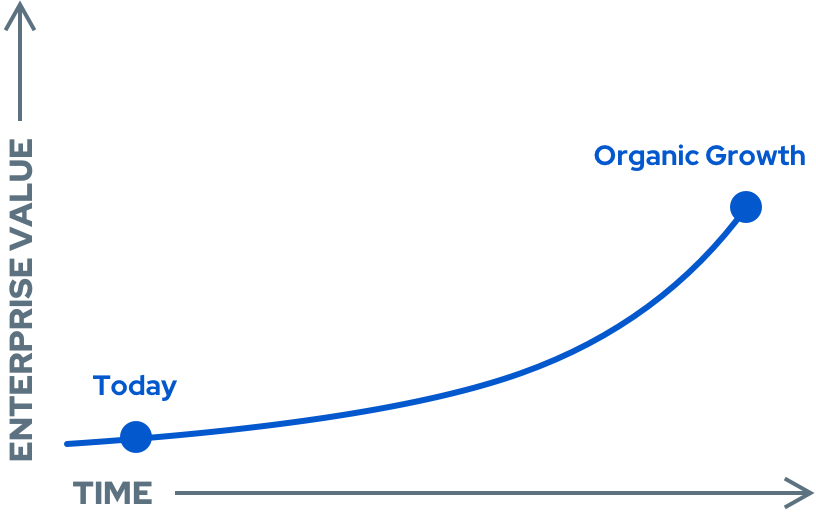

Value creation happens one of two ways:

- Organic growth

- Merger and acquisition

But how do you know which growth strategy is best for you?

Organic growth: A natural extension

Organic growth stems naturally from your business:

- Selling more products to existing customers

- Finding new markets through geographic expansion

- Developing new products to add to your existing range.

It’s knowing that you can keep building the company from the inside and compound the revenue and earnings year on year without putting a strain on your resources.

Mergers and acquisitions:

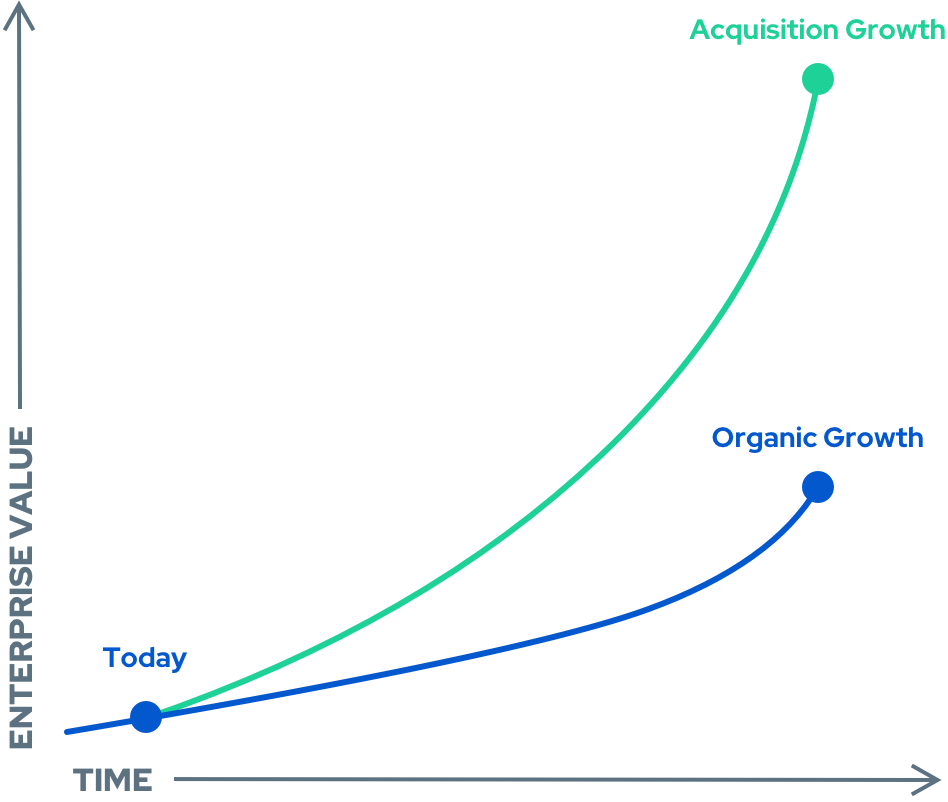

Faster growth but greater risk

For companies in growth mode, acquisitions can be an effective way to accelerate their expansion or fill gaps in products, talent, technologies or geographies.

Acquisitions can speed up your time to market with new capabilities, offerings and channels. Instead of developing a product from scratch or reskilling your team, a business acquisition can give you access to those things readymade.

People often think organic growth is cheaper, but most of the time creating a net-new offering and building channels to market on your own ends up being more expensive than simply buying it from someone else.

But doing an acquisition is not always a slam dunk. Most acquirers pursue targets opportunistically rather than methodically. You have to be across all of the key financial and integration issues to make it work.

Active Engagements

Transport and Logistics Acquisition

Client Goal

Purchase a transport and logistics hub with $1M+ revenue, existing fleet and operating infrastructure to expand the business’ geographic reach and growth opportunities.

Inflow Deliverable

Analyze the target business, conduct due diligence and create options for purchase, balancing the value and risk of the operation, negotiation and managing the business purchase.

A framework for acquisition evaluation

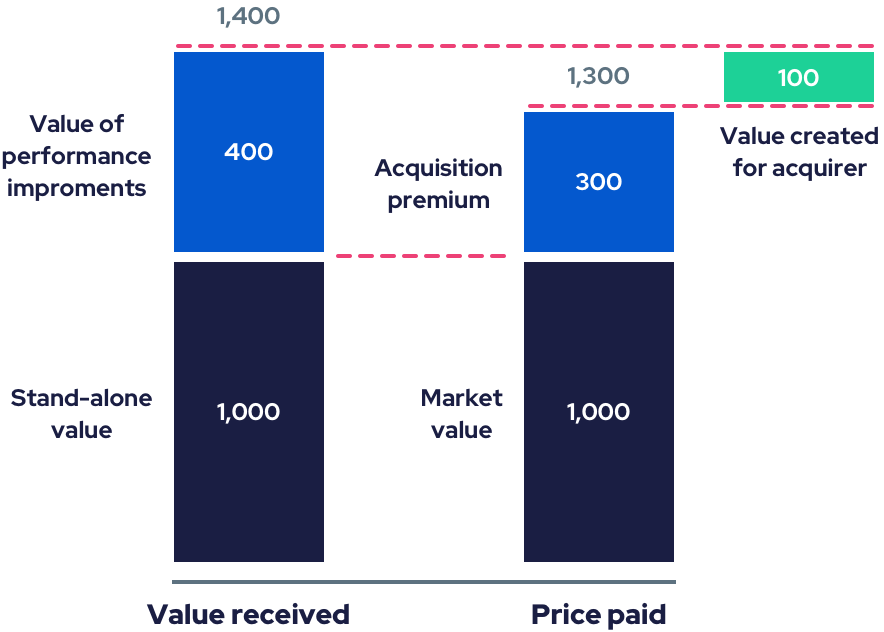

Value creation from an acquisition occurs when the revenues and cash flows of the combined companies increase and the performance improvements are properly captured over the long-term.

A simple acquisition evaluation framework

After the evaluation due diligence must follow. Allowing you to feel comfortable that your expectations of the transaction are correct.

Purchasing a business without doing due diligence substantially increases your risks. And this is why it helps to have an outsider take a look.

From experience we know that a healthy profit and loss statement can often mask the true viability of an organization. Other key elements such as cash flow, working capital, revenue, product, people, culture and tech enablement need to be factored in before you sign the deal.

We have literally saved our clients hundreds of thousands of dollars by helping them through how working capital needs to be factored into the sale price and what red-flags are acceptable or a no go.

A buy-side process you can use every time.

Initial Screening

We quickly scope and assess a target’s financial performance including revenues, earnings, cash flow and capital structure. Giving you a clear understanding of the numbers and investment thesis.

Due Diligence

We perform strategic due diligence. Key areas include the target’s financials, operations, people, infrastructure, revenue, strategy, customers and capital needs. We go inch wide, mile deep.

Pre-Post Valuation

Any acquisition should drive an uplift in Enterprise Value (profit and multiplier). What downside risks need to be defined and what improvements need to be prioritized? At the crossroads of an acquisition strategy and financing it lies valuation.

Deal Math

After we’ve uncovered the key findings and insights and priced the asset, we’ll work with you to construct a clear and concise offer that is structured and financed with the best possible terms and the most cost effective sources of capital.

Management & Close

Have the confidence knowing there is a defined process to follow, manage stakeholder expectations and negotiate a position to lock in the outcome and critical success factors for both parties.

Smooth Integration

Post transaction engagement and support is critical to ensure a smooth integration for maximum value creation.