Unfortunately, 95% of companies have a value gap problem, and they don’t even know about it.

If you ever want the option to sell your company in the future and be part of the small percentage of owners who can maximize their valuation on exit, you need to fix your value gap problem first.

That’s why it’s essential to learn how to identify and treat value gap problems early.

In this article we’ll be looking at:

What is a value gap?

What are the symptoms that start showing up

How to identify a company’s value gap problem

How do you fix the value gap

Optimize for exit outcomes, regardless

What is a Value Gap?

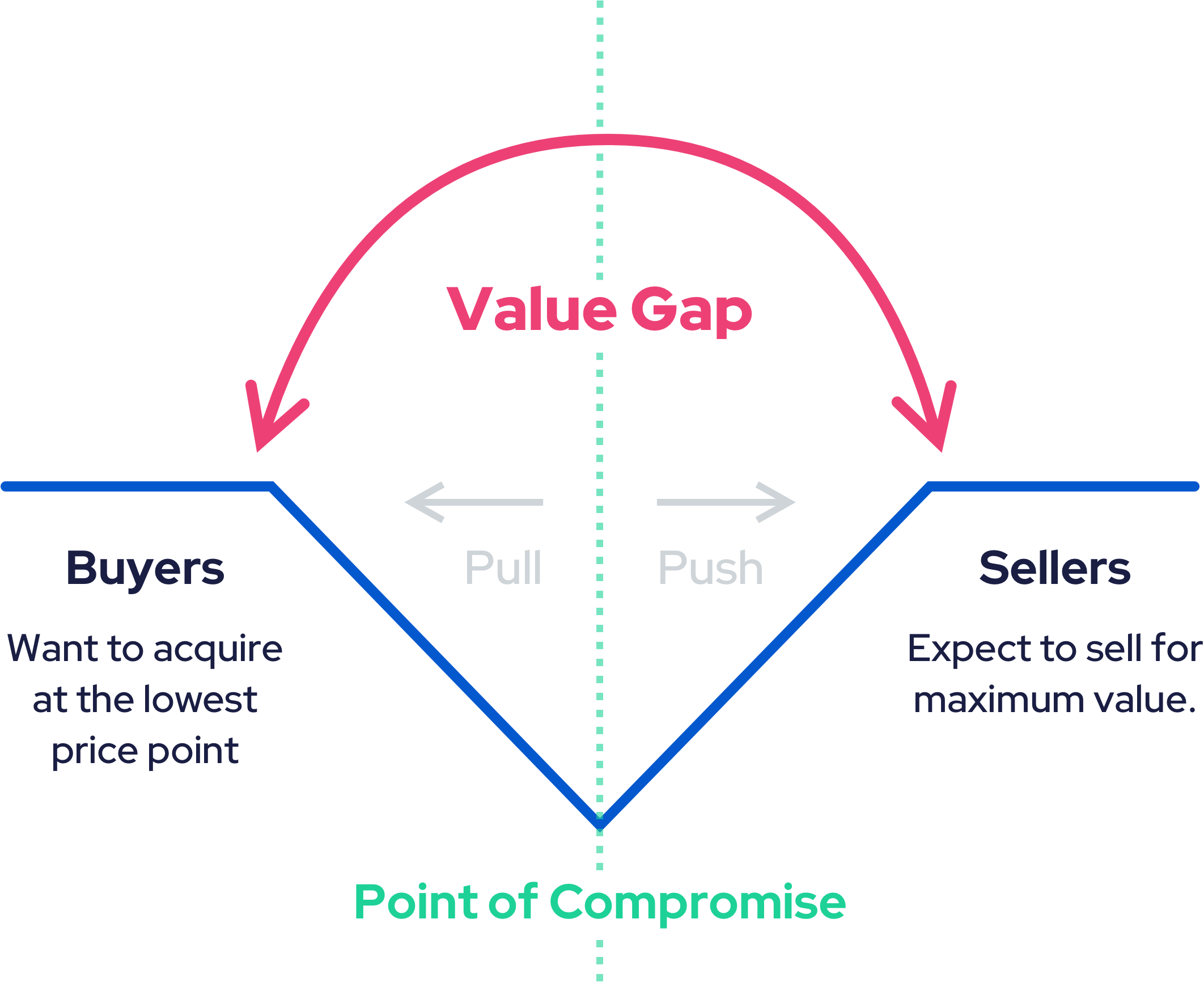

A value gap is the difference between the perceived value you have of your business and its actual market value. It’s when you expect to achieve a certain valuation based on how you run the company versus how a buyer perceives it if they had to operate it to generate a return.

While the value gap isn’t a highly complex problem, businesses don’t often recognise it until they need to transact and sell.

But at this point it’s too late and your options are limited to…

Withdrawing from the transaction - which is what often happens

Taking a massive haircut on your valuation - another common occurrence.

But before you get here, recognising the symptoms rather than ignoring them tends to be a more fruitful approach.

What Are the Symptoms of a Value Gap?

The road to identifying your company’s value gap problem starts with pinpointing the symptoms.

Common symptoms that show up in most companies:

Revenue growth has slowed or stalled

Your people are leaving

Customer satisfaction is low

Margins are trending negative

Or the symptoms can be less subtle such as:

Your business is still profitable even with an under-performing operation

You have a quality product with strong customer retention but no growth

The hardest thing to wrap your head around is that you can have both a value gap and a profitable business. Which doesn’t make much sense.

The biggest challenge most businesses never really face is identifying they have a value gap problem early enough so they can actually do something about it and avoid burning cash on continually treating symptoms rather than putting their capital into a solution.

To come up with an answer, we first need to clearly state what the value gap problem is.

How to Identify Your Company’s Value Gap Problem

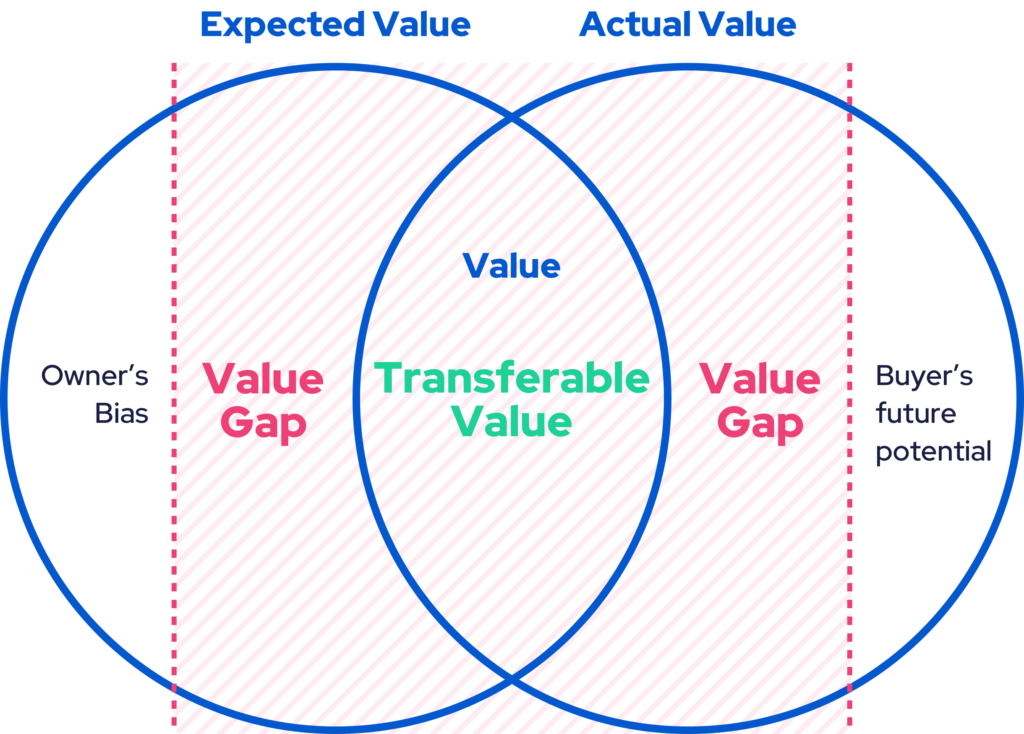

Below is the Value Gap Canvas that represents the overlapping of a business expected value with its actual value.

The left side is the expected value, which can be higher or lower than the market’s opinion of value. The right side represents the “actual value” which reflects what the market will be prepared to pay based on the transferable value your company creates or has.

When you as the owner set an expectation that doesn’t match a realistic listing price, then the value gap is created.

Pulling you further away from the expected or experienced value.

To identify this earlier, try this 2-part approach.

Step 1. Step Back and Take a Look

Most owners are firmly entrenched in day-to-day operations, so taking time out to step away from that is not easy. But asking macro type questions will give you proper perspective:

How is my positioning?

Does my positioning give a potential acquirer the wrong expectations from the outside?

Is my strategy clear?

If positioning is misaligned and your team doesn’t know how to communicate it, when you approach potential acquirers this will be perceived as a risk. Risk impacts price which only widens the value gap.

Next ask:

Is my business properly packaged so it can be sold?

Are my financials, legals, operations, sales, and products all organised in a way that I could present that data to a buyer?

People think organizing this sort of stuff is reserved for startups seeking investors. But you’re wrong. Established companies need to organize and package their business too. Whether you’re shooting for your next tender, arranging additional finance with the bank or attempting to sell the business, how you show up matters.

And being prepared and organized just makes good sense.

Because when a company isn’t organized and their data is all over the place – this makes it extremely challenging to transact. Again from the outside, the acquirer only sees this as a risk, which widens the value gap.

Next:

Does my business deliver a sufficient return compared to the level of risk of running it?

Do I have an inflated view of the returns it generates?

If you don’t have a clear and shared understanding of the returns your company generates balanced against the risks of operating it, your business may not be as great as you think it is. If your company struggles to grow and has flatlined in recent years, or operating profit has dipped, it’s time to take a deeper look at how well your business performs and whether it would still be attractive for acquisition (regardless of exit).

And finally:

Is my business slipping or scaling?

Should you undertake a repositioning strategy to align the business to the needs of the market?

The market is constantly evolving, and the customer base you have now may not always be there. The risk of competition, new technologies and consumers switching from one brand to another is a real risk to any business. Customer churn is inevitable, but this can accelerate if your competitors offer something you can’t.

This is the time to explore your business’ true value in the market. Can it be held together based on its current positioning and operating systems? Or is it slipping and losing market share?

If your business is having problems growing its customer base, expanding LTV and reducing churn would it be more beneficial to place it into someone else’s hands? Someone who has both the capital and capability to grow the base through larger distribution channels or a marketing and sales engine that can drive demand.

If you can do this in-house, you can start to close your value gap. If you can’t, it may be time to sell before those customers are gone, for good.

Step 2. Strategic Buyers vs Financial Buyers

To further understand your value gap problem, it’s essential you look at your business from a different lens. Understanding the difference between how strategic buyers and financial buyers view deals will give you a better perspective.

The value gap will be different for each type of buyer, based on their opinion of your business. By identifying the differentiations between strategic and financial buyers, you can gear your business in a certain direction to close the value gap or eliminate it completely.

What is a strategic buyer?

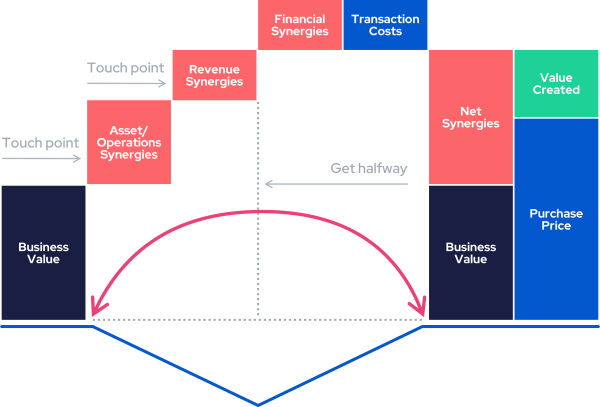

A strategic buyer is a company that acquires another company in the same industry to capture synergies. This could be product, team, technology or customer related reasons. The strategic buyer believes that the two companies combined will be greater than the sum of their individual parts and aims to integrate your business for longer-term value creation. Their primary objective is to identify a business whose products can be quickly absorbed into their existing operations without too much cost.

What is a financial buyer?

A financial buyer, on the other hand, is interested in making an investment in a company and realizing considerable returns from it. Typically financial buyers are private equity firms that use leverage to try and capture large financial returns. So the main task of a financial buyer is to identify companies that display huge growth potential and solid profitability.

The way a strategic buyer views your company is very different to a financial buyer. They both usually have access to capital and purchasing power but the criteria to follow to get in front of them is not the same.

But whether it’s a strategic or financial buyer, each will have their own views about the value of your company.

For example, when Facebook purchased WhatsApp for $19 Billion this was not a financial deal. WhatsApp had almost no revenue. No, this was a technology. Facebook could easily leverage through their massive user base and monetise later down the track for way more than the purchase price.

It’s a case where the company was more valuable to the buyer than it was to the founders who started it.

How Do You Fix the Value Gap?

The easiest way to exit is to SELL what the market wants to buy.

Therefore fixing the value gap is a matter of comparing the business you’ve built to the needs of the market.

A powerful and easy way to collect data is by approaching would be buyers about a particular part or parts of your business you believe would be valuable to them as well. Creating some key touch points before the acquisition discussion even comes up.

Each contact is called an Acquirer Touchpoint.

For example, some primary reasons to make a touch point are:

You know you have a competitive differentiation and the reasons why

Unfair advantages that a buyer cannot easily replicate

Intellectual property they may want to own

Customer locking strategies that would appeal to their situation, through a technology or specific process you use

Because building exit value is not just about company performance. It really comes down to having something others want, something that is hard, expensive or impossible for them to reproduce. This allows you to close the value gap much faster.

Also the feedback from those touchpoints is valuable. As it helps identify problems or holes in your business’ value proposition and at the same time provides an opportunity to simulate a buyer experience without the cost or hassle of taking it to market.

Reverse engineering the value gap from the ultimate buyer back to you is how you win.

For example, if you speak with 20 or more strategic buyers and they care more about the partnerships you’ve got vs the product you sell, that’s a major red flag to focus your time and attention on the attributes that make your partner channels unique and a must have.

Optimize for Exit Outcomes, Regardless

About 95% of businesses chase acquisition opportunities far too late in their growth cycle, and by the time they get to the point they want or need to exit, the business is not generating the returns it used to or it’s simply reached a point where growth has flatlined.

This puts you at the bottom of the pile of the countless deals acquirers look at every single day.

And if you can’t transact, your value gap only becomes even greater.

The companies that seem to avoid the value gap problem tend to lean in on greater activity before the company goes up for sale.

Every acquisition strategy has its time, place and role. Ideally you don’t want to have just one buyer interested, but several. This not only increases the chance your company will be acquired, but you will be able to leverage a competitive bidding process to maximize value.

Summing Up

Before taking your company to market in a rushed and often protracted process, you should take advantage of all the touchpoints and relationships you’ve built over the years. Learning from these touchpoints will save you a lot of time and potentially make you a lot more money in the form of an exit.

Not doing ANY of these things will only leave you with a value gap problem. Both in terms of how valuable your company actually is and not being able to capture a liquidity event at the right time.

You’ve likely invested a great deal of time and money and taken on a huge amount of risk with running your own business. Don’t be complacent about that. Because value gaps are real and it’s more likely you will experience a value gap problem than not.