It’s probably been some years since you started your business. No doubt you’ve experienced the high emotions and financial pressures that go with it, seeing the value of creating a durable business.

Putting the issues around COVID aside – Have you taken the time to step back and analyse the integrity of your business model and it’s long-term sustainability?

Before you were probably too busy to consider all this…but now you will be forced to make changes…

Because the rate of change happening in the economy and society is unprecedented.

Consider this.

- Rapid changes in technology

- Increasing costs of supply

- Climate change

- Increasing use of imports to meet customer demand for cheaper goods

- Greater pressure on operating margins from competitors

- Customer loyalty in decline

- Large demographic shifts with most businesses owned by the Baby Boomer Generation

- Rising employment, recruitment and training costs

- More businesses for sale trying to transact with buyers who have the capital and capability to keep them going.

It’s a big list…but it’s an accurate one.

And the majority of information you come across about how to navigate all this is incomplete. Because most of it focuses on the things that are going wrong, rather than what can be done to turn things around and establish a durable business. No one is telling you the whole story.

But adapting to change matters (probably more than ever). And instead of making simple changes – most have to now make drastic ones.

The question is, will you have the courage and motivation to take sustainable action?

We have to go deeper than before.

Focus on building back our lost equity to get to a brighter future.

To get you started on all this we need to take the right steps;

- Mindset

- Positioning

- Cash Flow

- Capacity Planning

- Better Operations

- Data Analysis

- Equity is the Future

- Mindset

- Positioning

- Cash Flow

- Capacity Planning

- Better Operations

- Data Analysis

- Equity is the Future

- Mindset

- Positioning

- Cash Flow

- Capacity Planning

- Better Operations

- Data Analysis

- Equity is the Future

Value creation inside of a business will now come in many forms, and it really doesn’t matter what stage of the journey you’re in, start-up, growth or maturity…this process is what you need to rebuild lost enterprise value and level-up so you can get back on course.

These seven steps are what I’ve used in my own businesses and the results are flowing in right now. Things are working like they should.

You likely already have some of these pieces, whereas some others may be new to you. So start where you need to and use this process so it actually works for you. The point is to focus on all seven, because these seven steps combined are what helps businesses reorganize and recover the right way.

It’s about creating a durable business and protecting the equity value of your business…and equity is all about the future.

Let’s begin with the foundations…

1: Reconfigure your mindset

Before the sales, marketing, finances, operations and everything else that everyone will tell you to figure out, it’s important you lay a very important foundation first. YOU.

It’s important to recognise the mindset you have going into this – the operating system you’re running on – will be deeply affected right now.

If you’re looking to turn your situation around it’s important you acknowledge this and admit to it, which is no easy thing.

However – if you can’t get your mindset right or you refuse to start here, nothing else inside of this guide will really matter to you.

Here’s why….

If your business revenue has fallen sharply you are now more likely the person doing most of the execution, most of the planning, and most of the operations. You now don’t own the business so much as you ARE the business.

So you must first realise in order to get yourself clear you have to delegate outcomes and look at your business through the right lens:

- Business owner - owns the business, but shouldn’t be emotionally attached to it

- CEO - manages the business

- Entrepreneur - (disrupts and innovates)

- Investor - (focuses on the numbers and finances and the growth of their investments)

These are the four hats you must wear, and little of it has to do with the actual work that needs to be done. What’s more important is that you start to work ‘smart’.

It’s the simple idea of ‘smart working’ that will force you to change, because all of a sudden your mindset starts to focus on the future – rather than dwelling on the past.

You stop trying to be everything inside of your business and instead take a proper step back so you can see the bigger picture.

Now I’m no mindset expert – but from experience this perspective has helped me.

It’s important you escape the scarcity and embrace abundance, because once you do you can roll into the business strategy with a much clearer focus.

2. Hyper-focus your positioning

People love to focus on marketing and lead generation…but in reality most of it doesn’t really work all that well. Marketing means very little if you don’t have your positioning properly figured out first.

And most businesses DO NOT have this figured out.

The marketplace often confuses the two (marketing and positioning) – but that’s not what Positioning is about. It should take place before anything else. Good marketers know this to be true.

Positioning impacts the entire business model to include how the business and your strategy operates.

You already know every business must sell, build something, deliver and service a customer. Most businesses do these operational management functions well and yet still struggle to create sustainable profit and growth. But getting your revenues back on line or building things better is not the whole solution for recovery or growth.

Before you go back out into the market you need to decide on the proposition to take to that market. Once you’ve developed that you can then fire up the marketing funnels and everything else you need to support it.

Why undertake Positioning?

In markets where there is so much uncertainty and choices available – a positioning strategy should be designed to put your product in the mind of your target consumer before somebody else’s. Because the consumer’s view is that all products look the same after a while.

And while we may take offence to this, the truth is – without a customer – you have no business.

Positioning is what makes the product stand out from the crowd. And when you own that mindspace that is when you have successfully positioned the business the right way.

It may take multiple attempts – but when you nail it – you’ll know.

So how do you hyperfocus your positioning?

There are three levels you need to consider:

- Position your product

- Understand your finances

- Position yourself for the future

It begins with your product, and this is where most businesses can go off track. Because most experts tell you to build a ‘value ladder’. That is awesome if you’re a $5 million business – but not if you’re making less than $1,000,000 a year – 96% of all businesses.

Because every time you focus on a value ladder you have to create the operating systems inside of your business to handle it – plus different messages and materials. You end up with all these different buying options – so when you do get a prospect on the phone, you overwhelm them.

If you are looking to rebuild your revenue and create a durable business – you should focus on delivering ONE product and park the rest until demand comes back. Understand who you can help, what problem you solve and how much it should cost.

Focus is everything now. And success will only come from the point at which you have focus. Focus will create a compound effect inside of your business that will allow you to build momentum back up again.

Once you know the product and offer is positioned properly, the next part is to understand the financials of it.

3. “Cash flow”…the lifeblood of your business

When you’re formlulating your strategy, you NEED to take cash flow into account. There is no exception here. Whether you’re starting out, growing or a mature business, how the cash flows through a business is critical.

It blows my mind how few businesses think about cash flow when reviewing their model and determining the viability of it.

Even businesses that come to us who are operating at 7 and 8 figures sometimes don’t have this part nailed down.

It’s not anything to do with how much money you have in your bank account. While that’s important, what’s even more important is the flow…

That money coming into it is more than what is going out of it. Not only that, the money that is coming in should come in quickly, whereas the money leaving should come out over a period of time.

Very few businesses view their cash flow through this simple lens.

It’s a missed opportunity because this stuff can be fixed with a few simple tweaks inside of the business.

Again it’s surprising how most overlook this part – but it’s the most important one. I’ve literally lost millions of dollars because I didn’t have this part figured out and if I could go back in time, it would be to understand the difference between:

- Cash generated - the value of the sale you close

- Cash collected - the money that actually lands in your bank account when you close the sale.

- Cash liability - the difference between the value of the sale and the money that has been paid thus far.

So what does this mean?

Let’s say you run a construction business and you quote someone to build their house – $1,000,000 build. We can say you’ve generated $1,000,000 because the customer has signed a contract with you. But the project will take 12 months to complete and you will receive payment via 12 installments at $100,000 every month. That means only $100,000 is deposited in your account at the time of the sale, so you’ve collected $100,000 this month. Therefore you have a liability of $900,000 that still needs to be paid.

This is a basic example but you really need to understand the difference here. You need to know the numbers coming in and going out. If you do not know this your business will struggle. But if you want to recover you need to remove the unknowns from the equation and secure the revenues the right way.

4. Capacity and knowing your numbers

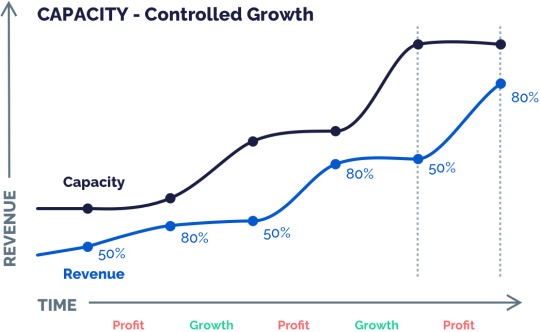

Capacity – in this context – is the maximum amount of revenue your business can generate given its current resources (staff, systems, products etc).

Traditional business plans often take too long to create and will never really tell you what to do and in what order things need to be done. They are simply not congruent with how a business is actually developed and can recover…

What is capacity planning

Every business has a running rate – this running rate – not revenue targets – is the most important number to understand to manage the future growth of your business.

The run rate shows you how best to increase your revenue. Because there is always a difference between the capacity you have and the actual amount of revenue you derive in any given period of time.

I bet you right now you have a ton of capacity – but no demand to fill it…

Understanding the gap between your running rate and its capacity are the inefficiencies sitting inside your business.

If you want to increase your revenue – you must fix these inefficiencies first.

The beauty of all this – is that you do not need to drastically alter your cost structures or make large investments of capital to make a business more efficient. But you need to pick the right modality.

Capacity planning framework

There are two modalities inside of a business that are in constant conflict with one another – both on the timing and the execution of initiatives.

- Growth mode - knowing when to grow and how much money to invest

- Profit mode - when to pull back - sharpen the saw - to generate higher margins

When you use capacity planning – you accept that these two modalities need to co-exist but outcomes in terms of capacity management will be different.

When you’re attempting to recover, Profit Mode is the most likely starting point. The functions and tasks do not increase the capacity of the business but rather improve utilisation and effectiveness of the current operating systems and people to increase revenue from within the existing mix of resources.

You will generate more profit – because while increasing revenues – your costs don’t change.

Initiatives that come to mind include:

- Focusing on Lead Quality NOT Quantity - don’t fill up your pipeline with people who aren’t ready to buy or don’t fit your customer profile.

- Refine Your Sales Process - a well planned sales strategy aims at increasing your conversion rates, average order values and make more back-end sales to increase customer share of wallet - a poorly designed or no sales strategy does the opposite - low-ticket sales and high customer churn rates

- Product Margins and Pricing - Pricing is a major factor in the success of a business. You want to earn as much margin as possible - but you must balance this at a competitive level. The first step is to go through every single product you sell and calculate the difference between margin and price markup. This strategy is so simple and ridiculously effective.

- Resource allocation - using the available resources you have in the near term to achieve specific goals in the future. It's the process of breaking down the areas the business needs to be supported in various projects and business units.

- Team capability - there is too much wasted time that goes on in a business. This time round your team members must have the capability to execute on the initiatives set out in the strategic plan.

Once you’ve moved your revenue up using the above you’ll then be ready to go into Growth Mode.

Growth is about increasing the capacity (or size) of a business.

It is very difficult to get high growth in a fractured market with no confidence. Scaling a business will only be reserved for businesses with the sufficient capital to do it.

You will need to be careful as to when you choose to grow. Because “growth sucks cash” from all the investments in:

- Marketing your brand

- Building distribution and channels to market

- Leverage with more infrastructure, adding team and building systems

- Introducing new products or services

These initiatives will most likely have to wait until the business has reached a point where the capacity is maximised and you can be sure those investments into growth are going to make financial sense.

It will be a timing thing and riding through the ups and downs until you get to this point again.

Remembering your business is an energy force and if you don’t manage it properly – on the profit motive and the growth ambitions – both you and your team will not know what steps to take.

5: Blowing up your team / operations

I’m not talking about firing everyone on your team. Blowing up your operations takes on two meanings here:

- You need to blow up your old operations because they will probably no longer work

- You need to create new operations to get the business back to a decent financial position

Everyone has been told they need to build a team to leverage their time inside of the business. You have to hire a team and create processes that free you up to work on the business and not in it.

You’ve heard this all before.

But what got you to this point – is not what will get you to the next.

Because in reality – most businesses are still completely dysfunctional. This is outside of what is happening with the pandemic.

When the founder or other team members get busy – you hire someone – so you can share the tasks around.

Now hiring from a place of ‘being busy’ you will come across some problems like:

- Duplication of effort and responsibility of tasks

- Excessive management time taken to make basic business decisions

- Staff frustration about not being able to finish their work

- People in the business selected to do things which don’t match their skill set

- No clear communication channel everyone is across

This is what a dysfunctional business looks like and it’s the wrong path to take if you want to create a durable business.

The reason why most businesses don’t get the growth and profits they deserve often translates from a very poorly designed strategy around their team / operations and the resource allocation within them.

Value chain resource allocation

There are 6 functional areas in every business:

| Value Chain | Purpose |

|---|---|

| Marketing | REVENUE generating |

| Sales | |

| Fulfilment | |

| Operations | Non-revenue generation – SUPPORT |

| Finance | |

| Strategy | GROWTH – equity value |

How long are you spending in each area and where is your team allocating their time?

This data should be captured and measured so you know how long people spend in each zone for the whole business.

Businesses generally don’t know the right percentages. But you must know this to maximise your business’ capability and speed up execution inside of it, creating a durable business. A workflow system that provides the founders and managers with where people are spending their time and what outcomes are being produced.

It’s getting to the root cause of the inefficiencies and waste that stalls both operations and growth. It’s also the reason why founders get stuck and become the bottleneck – relying on them to come up with all the ideas and initiatives to grow the business – but not only that – often seeing through to execution of them as well.

If you feel you are not able to bring the business back in a meaningful way – the answer may be hiding within the business and the allocation of its resources.

A durable business spends time in strategy. Those who don’t, often stall or fail to recapitalise and get momentum back.

6. Analyse your financial performance

When a business’s financial performance is drastically challenged like it is now – it helps to analyse things the right way.

Was your business profitable before?

If it was that’s great – but do you really understand how profitable your business really is.

Sometimes financial statements prepared by your bookkeeper or accountant can be misleading. That’s because they are out of date and out of touch with your current operations.

And yet these are often the very same financial statements used to review profitability and access more credit with banks and lenders.

Understanding your financial performance comes down to three things:

- Tracking the right numbers around your growth

- Reviewing the cash flows and financial management practices employed

- Using that information to make decisions

The best place to start with all this is to learn the key numbers that drive your growth are not in your P&L at all. You need to be look deeper this time – and slice your financial data down to see the lead indicators and the real performance of how healthy your business actually is:

- Lead generation and opt-ins

- Sales and conversion rates

- Gross margins (ensure they are maintained)

- Operating costs - (are they increasing)

- Fulfillment - customer delivery and payment times

- Customer mix - where is most of the revenue in your business coming from - is there any concentration and what is the average LTV of each customer.

- Product mix - what products are the most popular that have the best margins

From viewing this information you may find trends and insights that you didn’t see before – because often – it’s the least profitable parts of the business that drag down the whole operation.

And the things you don’t see can often cause the most damage.

There is nothing strategic about losing more money in the hope you can ‘get to even’ one day and maybe profit.

If your finances and profitability weren’t healthy before – the chances your business will recover are minimal.

This is vital for you to know and understand as you seek to create a durable business.

7. Equity is the future

Before you go running off to your bank to plug the cash flow holes – you need to put in the work on the above strategies and so much more.

The right strategy, selling the right products along with the right numbers being tracked will turn your business around slowly – but in the long term you will be much better off.

Taking on more debt to fund your cost structures is dangerous. And it flat out won’t work.

And here’s why…

The use of cash inside of your business is more vital than ever.

How you allocate the money you have and use it in the right areas to generate profitable growth in the future will be vital to your longer term success.

Probably the #1 weakness of growing businesses is effective marketing and lead generation, followed closely by #2, poor financial management.

Whether you’re sitting on a pile of cash or a mountain of debt – these lessons are invaluable.

Cash flow is the change in cash and debt balances in a business.

You will spend money every day to grow your business. However you may be spending your hard-earned money to fund financial and operational waste.

It highlights the point that there are really only two uses of cash inside of your business.

- Cash you use to invest in growth

- Cash that is used to fund mismanaged operations

Too few businesses are able to visualize their cash flow in this simple framework.

While there are many measures and metrics that contribute to the overall success of a business you need to focus on two:

- Free cash flow

- Returns

A business’ equity value needs to be positive to remain sustainable.

Too many businesses have negative cash flow and equity because of poorly designed business models, cost structures and financing arrangements.

Contributors to equity growth on the balance sheet include growing margins and optimising your working capital – ensuring you’re getting a return on the net assets (return on capital) you’ve invested.

This is going to be the most powerful financial ratio for managing your overall effectiveness as it combines your profit performance and how well you’re managing your balance sheet (finances).

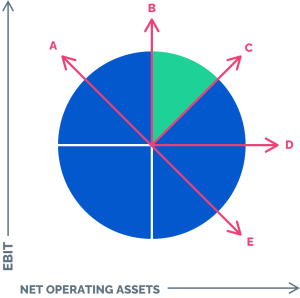

Your return on assets is ultimately a measure of the success of your strategy. If your return is not at a level you need it to be then you have five options available:

If you grow EBIT and net operating assets at the same rate, your business will travel nicely along the C line. Your returns will be consistent.

If you grow EBIT and keep net operating assets constant you will then find yourself on the B line, returns will start increasing.

If you increase EBIT and reduce net assets, then you will start to see even healthier returns. However, there is warning, because option A is simply not sustainable in the long term and should only be used as a dramatic change to get short-term liquidity relief.

Businesses will no doubt see a flat line in their EBIT and may try to reboot things by increasing net operating assets (option D) or if the EBIT reduces (more than likely) and you try to increase the operating assets i.e. borrow to invest… you will go down the E line.

This is not to say one pathway is better than the other – but each will impact the equity value of the business and the overall return on capital.

There is no doubt there are strategies deployed during major investment periods – like with early stage companies – when you will choose to invest in new infrastructure – but the strategy must be congruent with generating more significant increases in EBIT over the long run.

If you’re trying to turn things around and create a stable, durable business – you will need strategies that focus between B and C, where you are increasing EBIT faster than you are growing net assets…i.e. leaving the business in Profit Mode to grow your top line and earnings and leaving your assets for the time being.

Raising cash from investors does not create equity growth. It’s merely a funding bridge.

Contemplating an investment round needs to correlate to a well developed strategy, a good understanding of the financial fundamentals to make it work and the business’ ability to come out of profit mode and back into growth – to generate future returns.

Take action without getting overwhelmed

If you’re behind break-even, I hope this guide helps you see what’s possible.

However the problem for you will be 3 things.

Either your mindset sabotages you and you set off in the wrong direction (wasting more of your own hard-earned money) or you can’t quite get your strategy in alignment between you and the market you serve. Or you’re still in a position to operate but the leads aren’t buying as much as they used to.

That’s why I formulated this simple assessment to get completely across the key factors you need to solve your problems QUICKLY so you can map out what you need to fix inside of your business and fast track your way out of uncertainty.

Book in a call with us today to understand how your business is going, how you can prepare for the future and create a durable business.

- Keep the business going as is

- Make changes to the business model

- Evaluate your entire business because it's just not working like it should be